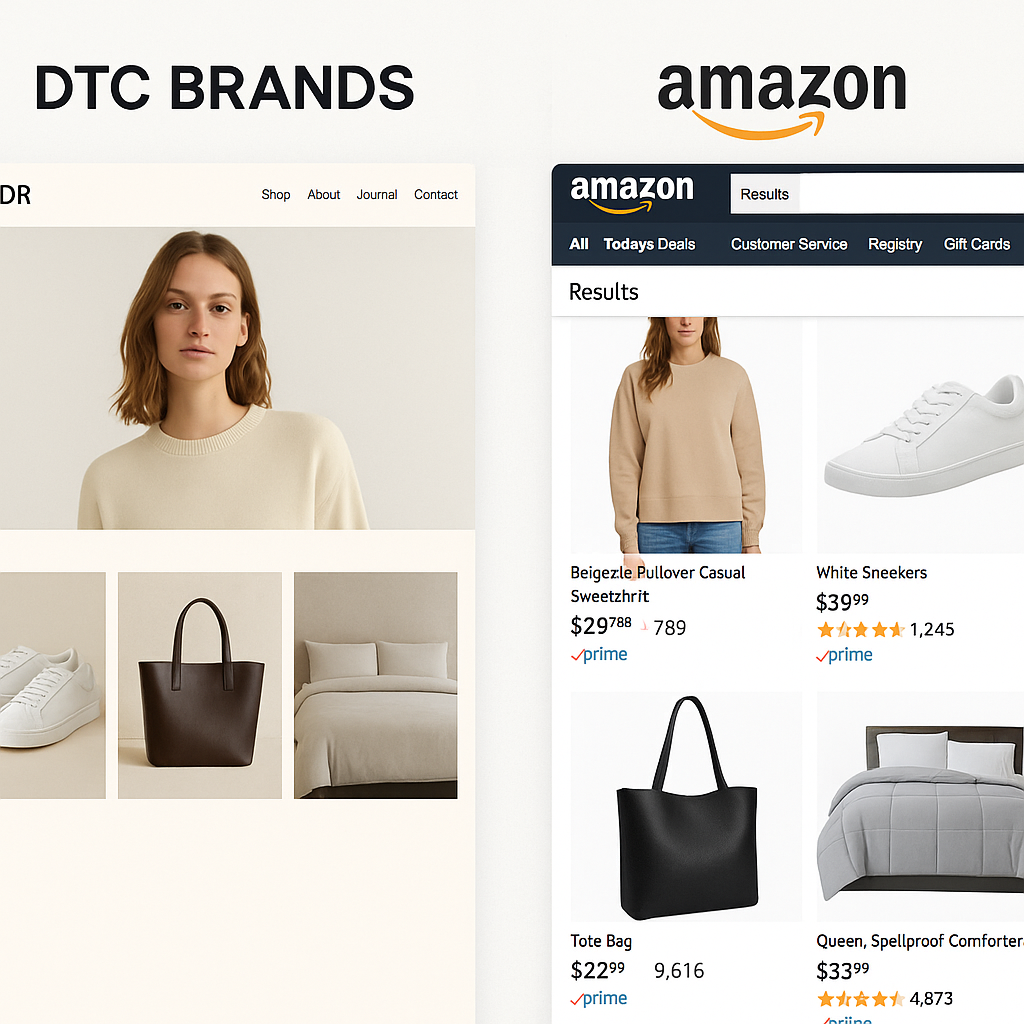

DTC vs. Amazon: Should Brands Go Direct or Stick with Amazon?

The modern eCommerce landscape presents brand owners with a critical strategic decision: build a direct-to-consumer (DTC) channel, leverage Amazon’s massive marketplace, or find the right balance between both. This choice impacts everything from profit margins and customer relationships to brand control and scalability.

Today’s most successful brands are carefully evaluating these channels not as an either/or proposition, but as complementary components of a sophisticated growth strategy.

In this comprehensive guide, we’ll explore the fundamental differences between DTC and Amazon selling models, analyze the unique benefits and challenges of each approach, and provide actionable frameworks to help determine the optimal channel mix for your brand’s specific circumstances and objectives.

Understanding DTC and Amazon: Business models explained

Before diving into strategic recommendations, it’s essential to understand the core differences between selling direct-to-consumer and through Amazon’s marketplace.

DTC selling involves brands creating their own sales channels—typically through branded websites and apps—where they maintain complete control over the customer experience, pricing, and data collection. This model eliminates traditional retail intermediaries, allowing brands to build direct relationships with end consumers.

Amazon selling, by contrast, leverages the retail giant’s established marketplace, fulfillment infrastructure, and enormous customer base. Brands can participate in Amazon’s ecosystem in several ways:

- 1P (First-party): Brands sell wholesale to Amazon, which then resells products to consumers as the retailer

- 3P (Third-party): Brands sell directly to consumers through Amazon’s marketplace, paying fees and commissions

- Hybrid: Utilizing both models simultaneously for different products or categories

The key differences between these approaches extend across multiple operational dimensions:

- Customer ownership: DTC provides full access to customer data and relationships; Amazon largely restricts this access

- Brand experience: DTC offers complete control over presentation and storytelling; Amazon provides limited customization within its ecosystem

- Operational responsibility: DTC requires building your own infrastructure; Amazon offers turnkey logistics and customer service

- Economics: DTC typically delivers higher margins per sale but requires significant investment in traffic acquisition; Amazon offers built-in traffic but charges substantial fees

The hybrid approach: Combining DTC and Amazon

Many successful brands have moved beyond viewing these channels as mutually exclusive. The hybrid approach recognizes that different channels can serve different purposes within a comprehensive eCommerce strategy. For instance, Amazon may serve as a customer acquisition and brand discovery tool, while the DTC channel focuses on retention, premium experiences, and higher lifetime value.

Integration tools like Amazon’s “Buy with Prime” further blur these boundaries, allowing brands to offer Amazon’s trusted fulfillment experience directly on their DTC sites. This represents a growing recognition that consumers expect seamless experiences regardless of channel, and brands need flexibility to meet these expectations.

Benefits of building a DTC brand

Establishing a direct-to-consumer channel offers significant advantages that make it an essential consideration for modern brands seeking sustainable growth and long-term equity.

Direct ownership of the customer relationship represents perhaps the most valuable aspect of the DTC model. When consumers purchase through your owned channels, you collect first-party data on their preferences, browsing behavior, and purchase patterns. This information becomes the foundation for personalized marketing, product development, and creating exceptional customer experiences that drive loyalty.

Brand storytelling flourishes in the DTC environment. Without platform constraints, brands can create immersive experiences that communicate their values, mission, and unique selling propositions. This storytelling capability proves especially valuable for premium or specialized products where education and emotional connection drive purchase decisions.

Financial advantages also factor prominently in the DTC equation. Without marketplace fees or wholesale margins, direct sales typically yield significantly higher profit margins per transaction. This margin advantage provides breathing room for marketing investment, premium packaging, and enhanced customer service—all contributing to brand differentiation.

Agility represents another compelling benefit of the DTC approach. Brands maintain complete control over:

- product assortment and merchandising

- pricing strategies and promotions

- website experience and checkout flow

- customer communication and service protocols

- product launch timing and marketing campaigns

This control allows for rapid testing, optimization, and adaptation to changing market conditions—a critical advantage in fast-moving consumer categories.

Finally, scaling DTC operations creates compounding strategic advantages. As direct customer relationships grow, acquisition costs typically decrease through referrals, repeat purchases, and community building. The expanding first-party data set becomes increasingly valuable for personalization and product development, creating a virtuous cycle that strengthens competitive positioning.

Why brands should still consider Amazon

Despite the compelling case for direct-to-consumer selling, Amazon’s marketplace presents undeniable advantages that make it a crucial consideration in almost any eCommerce strategy.

The sheer scale of Amazon’s customer base represents its most obvious benefit. With over 200 million Prime members worldwide and its position as the starting point for approximately 63% of product searches, the marketplace offers unparalleled reach. This customer acquisition potential proves especially valuable for new or emerging brands lacking established traffic sources.

Consumer trust also factors prominently in Amazon’s value proposition. The marketplace’s familiar interface, reliable fulfillment, and robust review ecosystem reduce friction in the purchase journey—particularly important when introducing new products or entering unfamiliar categories. This built-in credibility can accelerate adoption rates compared to standalone eCommerce sites.

Operational advantages further enhance Amazon’s appeal. Through Fulfillment by Amazon (FBA), brands can leverage the company’s sophisticated logistics network, offering benefits including:

- nationwide two-day (or faster) shipping capabilities

- simplified inventory management across multiple locations

- streamlined returns processing and customer service

- eligibility for Prime badge and enhanced visibility

- reduced operational complexity for growing brands

The marketplace also offers sophisticated tools for brand building. Amazon’s Brand Registry unlocks access to A+ Content (enhanced product descriptions), Brand Stores (customized multi-page experiences), and sponsored brand campaigns—all helping to differentiate products within the platform ecosystem.

For many brands, Amazon represents an important channel for business resilience. By diversifying beyond a single sales channel, companies reduce risk exposure to technical disruptions, algorithm changes, or traffic volatility that might impact their independent eCommerce operations.

Real-world brand outcomes: Case study snapshot

A premium kitchenware brand initially built its business exclusively through direct-to-consumer channels, focusing on high-quality product education and premium customer experiences. After adding Amazon as a complementary channel with differentiated product bundles, the company expanded its customer base by 40% within six months, capturing different demographic segments than their DTC channel.

Importantly, their DTC conversion rates remained stable, suggesting Amazon created incremental growth rather than cannibalization.

Key challenges and risks—DTC vs. Amazon

Both selling approaches present distinct challenges that require careful consideration and proactive management strategies.

For DTC operations, customer acquisition costs represent the most significant hurdle. Without Amazon’s built-in traffic, brands must invest heavily in paid advertising, content marketing, and social media to drive website visitors. These acquisition costs continue rising across digital channels, placing pressure on unit economics and profitability—especially for lower-priced products.

Technical complexity also challenges DTC brands. Building and maintaining a competitive eCommerce experience requires investments in:

- website development and optimization

- payment processing and fraud prevention

- customer service platforms and processes

- analytics and business intelligence tools

- integrations with fulfillment and inventory systems

Operational infrastructure presents another major challenge. DTC brands must establish efficient fulfillment networks, negotiate competitive shipping rates, and manage returns processing—capabilities that typically require significant scale to optimize. For smaller brands, these logistical challenges can divert focus from core competencies like product development and marketing.

On the Amazon side, margin pressure represents the foremost concern. Between referral fees (typically 15%), FBA costs, advertising expenses, and competitive pricing pressure, brands often see substantially lower per-unit profits compared to direct sales. This squeeze intensifies during promotional periods and in competitive categories.

Limited customer data access constrains relationship building on Amazon. The marketplace restricts access to customer email addresses and browsing behavior, complicating remarketing efforts and limiting opportunities for personalization and loyalty development.

Brand experience control remains another significant limitation. Despite improvements in brand content tools, Amazon’s standardized interface and emphasis on comparison shopping can undermine differentiation efforts. Product listings appear alongside competitors, and the platform prioritizes price and convenience over brand storytelling.

Finally, platform dependency creates vulnerability. Amazon’s evolving algorithms, fee structures, and policies can significantly impact performance with little notice, leaving brands scrambling to adapt to changing rules.

How to mitigate channel overlap and cannibalization

When operating both DTC and Amazon channels, strategic differentiation becomes essential to minimize internal competition and maximize channel-specific advantages.

Product assortment strategies offer the most direct approach to channel differentiation. Options include:

- Exclusive products: Reserving certain products or variations for specific channels

- Strategic bundling: Creating channel-specific bundles with unique value propositions

- Limited editions: Launching time-limited products through specific channels

- Tiered offerings: Positioning premium products on DTC while offering entry-level items on Amazon

Pricing strategies should recognize channel economics while maintaining consistency where channels overlap. Brands can maintain MAP (Minimum Advertised Price) policies, adjust standard retail pricing to account for marketplace fees, or create bundles with unique price points that avoid direct comparison.

Marketing differentiation helps channels serve distinct purposes. Brands might position Amazon as a discovery and trial channel while emphasizing community, exclusivity, and deeper brand engagement through DTC marketing. Segmented messaging ensures each channel’s value proposition remains clear to consumers.

Making the right choice: When (and how) to go DTC, Amazon, or both?

Determining the optimal channel strategy requires evaluating your specific business context against several critical factors.

Brand maturity significantly influences channel prioritization. Early-stage brands with limited awareness often benefit from Amazon’s built-in traffic to establish market presence and gather initial customer feedback. More established brands with strong direct traffic sources may emphasize DTC while using Amazon as a complementary channel.

Product characteristics shape channel suitability. Consider these factors:

- Price point: Higher-priced items typically perform better on DTC where education and brand storytelling can justify premium positioning

- Complexity: Products requiring substantial education or customization favor DTC environments

- Replenishment frequency: Regular replenishment items may benefit from Amazon’s Subscribe & Save program

- Competitive density: Highly commoditized categories face intense price competition on Amazon

- Physical characteristics: Heavy or bulky items benefit from Amazon’s fulfillment infrastructure

Resource availability—including team capabilities, technology infrastructure, and capital—directly impacts execution quality. Brands with limited operational experience or technology resources might start with Amazon to leverage its turnkey infrastructure while developing DTC capabilities over time.

Customer preference research should inform channel prioritization. Understanding where your target customers prefer shopping for your specific category provides essential guidance. Some demographic segments demonstrate strong channel preferences that should align with your distribution strategy.

For brands pursuing an omnichannel approach, consider this implementation sequence:

- Establish clear channel-specific objectives and success metrics

- Define differentiated positioning and offerings for each channel

- Implement robust inventory management across channels

- Develop channel-specific marketing strategies that minimize overlap

- Create measurement systems that track cross-channel impact

Most importantly, channel strategy should align with long-term brand objectives. Brands prioritizing customer relationship building and premium positioning might emphasize DTC despite higher acquisition costs, while those focused on rapid revenue scaling might lean more heavily on Amazon’s reach.

Conclusion

The DTC versus Amazon decision represents a false dichotomy for most modern brands. Rather than choosing one channel exclusively, successful companies increasingly adopt sophisticated omnichannel approaches that leverage the complementary strengths of each platform while mitigating their respective limitations.

The optimal strategy balances immediate business needs with long-term brand building. Amazon offers unparalleled reach and operational efficiency, making it valuable for customer acquisition and geographic expansion. Direct-to-consumer channels provide control, higher margins, and relationship-building capabilities essential for sustainable competitive advantage.

Ultimately, execution quality determines success in either channel. Brands that invest in channel-specific expertise, maintain consistent customer experiences across touchpoints, and continuously optimize their channel mix based on performance data will outperform those taking rigid, dogmatic approaches to distribution.

The most important step is moving beyond theoretical debates to developing a practical, data-informed channel strategy tailored to your specific brand context, resources, and growth objectives.

Frequently asked questions

Is it better to sell DTC or on Amazon?

It depends on your brand objectives, resources, and customer base. Many successful brands use both channels for growth and resilience.

What are the main pros and cons of DTC vs Amazon?

DTC provides more control and data, while Amazon brings scale and credibility but can reduce margins and access to customer data.

Can selling on Amazon hurt my DTC brand?

If unmanaged, it can cause channel cannibalization; using differentiated product lines or offers minimizes this risk.

Does launching on Amazon mean I should abandon DTC?

No; the best results often come from a coordinated omnichannel approach.

How do I transition from Amazon 1P to DTC or hybrid?

Evaluate logistics, tech stack, and marketing capabilities, and consider a phased approach leveraging 3P or hybrid models with testing.